B2B Market Research for SaaS Startup Growth

Forget guesswork. When we talk about B2B market research, we’re talking about the systematic process of gathering and analyzing information about your business customers, your competitors, and your industry to make smarter strategic decisions. For a SaaS startup, it’s the secret weapon that replaces risky assumptions with real-world evidence, ensuring you build a product that companies actually want to buy.

Why Market Research Is Your Startup's Secret Weapon

In B2B SaaS, even the most brilliant product idea can fail if it doesn't solve a genuine, urgent business problem. I’ve seen it happen time and time again: startups fall in love with their solution before truly understanding the problem it’s meant to fix.

This is exactly where foundational B2B market research becomes your most valuable asset. This isn't about creating stuffy, academic reports nobody reads. It’s about building an unshakeable connection with your future customers.

This process is what moves you from "we think" to "we know," transforming abstract ideas into a concrete strategy. It's your opportunity to de-risk your entire venture before you write a single line of code or spend a dollar on marketing. By talking directly to your target audience, you uncover the nuances of their daily challenges, their budget constraints, and even the internal politics that drive purchasing decisions.

Build What Truly Matters

Effective B2B market research lets you step inside your customer's world. You learn their language, understand their workflows, and identify the pain points they might not even know how to articulate. This deep empathy is what separates market-leading products from the sea of "me-too" solutions.

But this isn’t just about validating an idea you already have. It’s about discovering what to build next, how to price it, and the exact words to use in your marketing. These insights directly inform your product roadmap and your go-to-market strategy, creating powerful alignment across your entire team.

"The goal of research is to go beyond what customers say they need and uncover the unspoken truths that drive their behavior. This is where you find your competitive edge."

Gain a Lasting Competitive Advantage

Your competitors might have more funding or a larger team, but insightful research can be your great equalizer. While they operate on old assumptions, you can adapt to meet the evolving needs of the market with precision. Believe me, the investment in understanding your market pays dividends that compound over time.

This commitment to intelligence is a big reason why the B2B Market Research Market, valued at USD 74.34 billion, is projected to skyrocket to USD 121.61 billion by 2030. Businesses everywhere are realizing that market intelligence is no longer optional—it's critical for anyone aiming to thrive.

Ultimately, the insights you gather influence every single touchpoint a customer has with your brand. For instance, understanding how buyers actually evaluate solutions can dramatically improve the structure and messaging of your website. If you're curious about how to turn this research into real results, you might be interested in our guide on creating a high-performance website design for B2B companies.

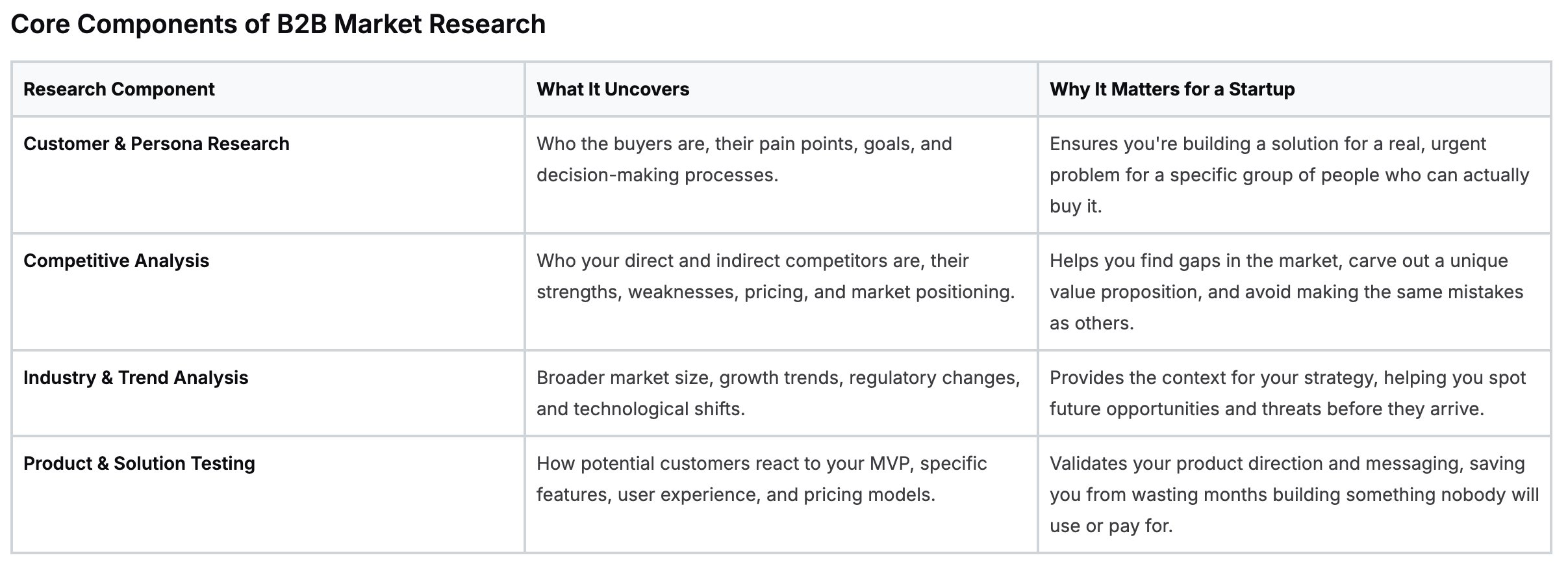

Here’s a quick rundown of the core pillars we’ll be discussing. Think of this as your strategic cheat sheet for getting started.

Core Components of B2B Market Research

Each of these components feeds into the others, creating a complete picture that guides everything from product development to your first sales pitch. Getting this right from the start is what separates the startups that take off from those that never leave the ground.

Defining Your Research Mission and Goals

Kicking off a research project without clear goals is like setting sail without a compass. You’ll drift around, burn through cash and time, and end up with a folder full of interesting-but-useless data. So, before you do anything else in your B2B market research, you have to define your mission. This is the crucial first step that turns vague curiosity into a focused, powerful investigation that actually drives business decisions.

Forget about generic objectives like "understanding the market." Your goals need to be sharp, specific, and tied directly to a critical choice you need to make. This is where you separate the academic exercises from the actionable intel.

Think of it this way: every question you ask should help you decide what to do next with your product, your pricing, or your marketing.

From Vague Ideas to Actionable Questions

Let’s get practical. Say you're a SaaS startup, and your user adoption numbers are… not great. A weak goal would be "research customer needs." A powerful goal gets to the heart of the problem you're trying to solve.

Here’s how you can sharpen those fuzzy ideas into precise research questions:

- Vague Idea: "We need a better pricing strategy."

- Actionable Question: "Which pricing model—per-seat or usage-based—resonates most with Series A funded tech companies in the fintech space?"

- Vague Idea: "Let's find out what our competitors are doing."

- Actionable Question: "What are the top three integration challenges that mid-market CFOs face when using our main competitor’s software?"

See the difference? This level of specificity guarantees that every hour you put into research delivers a real return. You’re not just collecting facts; you're hunting for answers that will give you an edge.

A well-defined research question is half the answer. It gives you the clarity to pick the right methods, find the right people to talk to, and ultimately uncover insights that can change the game.

Tying Research Goals to Business Impact

Your research objectives must always connect back to a tangible business outcome. This not only helps you prioritize what's important but also makes it way easier to get buy-in from the rest of your team. The key question to ask is: what will we do with this information once we have it?

For instance, I once worked with a SaaS startup getting ready to launch a major new feature. Their research mission wasn't just to "validate the feature." They needed to figure out exactly how it would shape their entire go-to-market strategy.

Here’s what their goals looked like:

- Identify the primary use case that creates the most value for our ideal customer profile.

- Determine the key messaging that will make this feature a "must-have" during sales demos.

- Pinpoint which channels are most effective for reaching early adopters for this feature.

Because they set these clear goals upfront, their research findings directly fueled their launch plan—from the marketing copy on their landing page to the sales scripts their team used.

This kind of clarity is also foundational for building powerful growth engines. To explore this further, check out our proven tactics for successful B2B demand generation. When your research mission is clear, every action you take afterward becomes more focused and a whole lot more effective.

Building Your Scrappy Research Toolkit

Alright, you've got your research mission locked in. Now it's time to build your toolkit. Let’s be real—as a startup, you’re not working with an enterprise-level budget for B2B market research. But that's a good thing. It forces you to be resourceful, and resourcefulness is where the real breakthroughs happen.

The secret isn’t spending more; it’s about knowing where to look and what to ask. We’re going for a “scrappy” approach here, blending low-cost digital tools with some clever human-to-human tactics to get the answers that truly matter. Forget generic Google searches. Your goal is to get high-quality, firsthand information that gives you a genuine edge.

Think of yourself as a detective. You’re moving past the obvious and diving deep into the channels where your actual customers live, work, and—most importantly—complain.

Mastering Qualitative Insights

The heart of scrappy research is simple: talk to people. While all the quantitative data in the world can tell you what is happening, it’s the qualitative insights that tell you why. And the "why" is where the gold is buried.

- Customer Interviews: Ditch the surface-level questions. Instead of asking, "Do you like our new feature?" try this: "Walk me through the last time you had to deal with [the problem your startup solves]." This open-ended prompt uncovers their real-world frustrations, motivations, and the clever workarounds they’ve already invented—intel you’d never get from a survey.

- Niche Online Communities: Your ideal customers are already gathered online, talking about their biggest headaches. You just have to find them. Think specialized subreddits (like r/sysadmin for IT tools) or niche Slack and Discord communities. Lurk for a bit. Pay attention to the exact language they use, the solutions they praise, and the ones they rip apart.

Once you start gathering interview recordings and community threads, the analysis can get overwhelming. This is where you can be smart with your time. For example, after your interviews, you can speed up the synthesis process by leveraging Docsbot AI for research to transcribe and pull out key themes automatically.

Digital Eavesdropping for Strategic Advantage

Your prospects are constantly leaving a trail of digital breadcrumbs. All you have to do is follow it. Today’s B2B buyers are researchers themselves. In fact, they’ll run about 12 online searches before ever engaging with a brand. With customer experience now driving 80% of purchase decisions, understanding their digital journey is non-negotiable.

This is where you get to put on your digital sleuth hat:

- Competitor Review Mining: Get intimately familiar with sites like G2, Capterra, and TrustRadius. Don’t just skim the five-star reviews; the one-star reviews are where the magic happens. Look for patterns in what customers absolutely hate about your competitors. A scathing review is basically a product roadmap handed to you on a silver platter, highlighting a critical gap you can fill.

- LinkedIn Sales Navigator: This tool is for so much more than just lead gen. Use it for deep audience research. You can filter by job title, company size, and industry to get a crystal-clear picture of your target market's professional landscape. Go a step further and analyze profiles to see what skills are in demand and what topics people are actively discussing in their posts.

The most powerful insights often come from observing what people do, not just asking what they say they’ll do. Behavior is truth.

These scrappy methods don't require expensive, enterprise-level software. They just require curiosity, empathy, and a little bit of hustle. By combining direct conversations with smart digital analysis, you’ll build an understanding of your market that is far more valuable and actionable than any pricey, off-the-shelf report could ever be.

All your planning and strategy work comes to a head right here. Moving from a defined plan to actually reaching out and analyzing what you find is where you turn all that theory into tangible, hard-hitting intelligence.

The whole point isn't just to check boxes and collect data. You're aiming to spark real conversations that uncover the unspoken truths behind your customers' biggest headaches. Your confidence and clarity in this phase have a direct impact on the quality of insights you’ll walk away with.

Breaking Through the Noise and Getting to the Truth

Getting busy executives to talk to you is an art form. Forget the generic templates you see everywhere. Your email or LinkedIn message needs to be personalized, sharp, and focused on their world, not yours.

A great way to do this is to reference something specific they've done or said. Maybe you saw a post they made or a challenge unique to their industry. An opening line like, “I saw your comment on the latest challenges in supply chain logistics, and it sparked a question about…” instantly shows you’ve done your homework. It’s not about you; it’s about a topic they already care about.

Once you land an interview, your mission is to listen more than you talk. Get their permission to record the conversation so you can stay fully present instead of frantically taking notes. After you’ve gathered all this rich, qualitative data, the real work begins: turning those conversations into insights. To do this well, you'll need to get comfortable with a few key qualitative data analysis techniques to spot the patterns, themes, and those surprising outlier comments that often signal a hidden opportunity.

Structuring Your Findings for Real-World Action

How you organize your findings is just as important as how you collect them. Don't just dump everything into a massive document.

For your qualitative interviews, create a simple system. Tag key quotes and observations related to specific pain points, desired outcomes, or competitor mentions. It makes it so much easier to see the patterns emerge. For secondary research, like analyzing market trends, having a structured document is absolutely essential to keep things from getting chaotic.

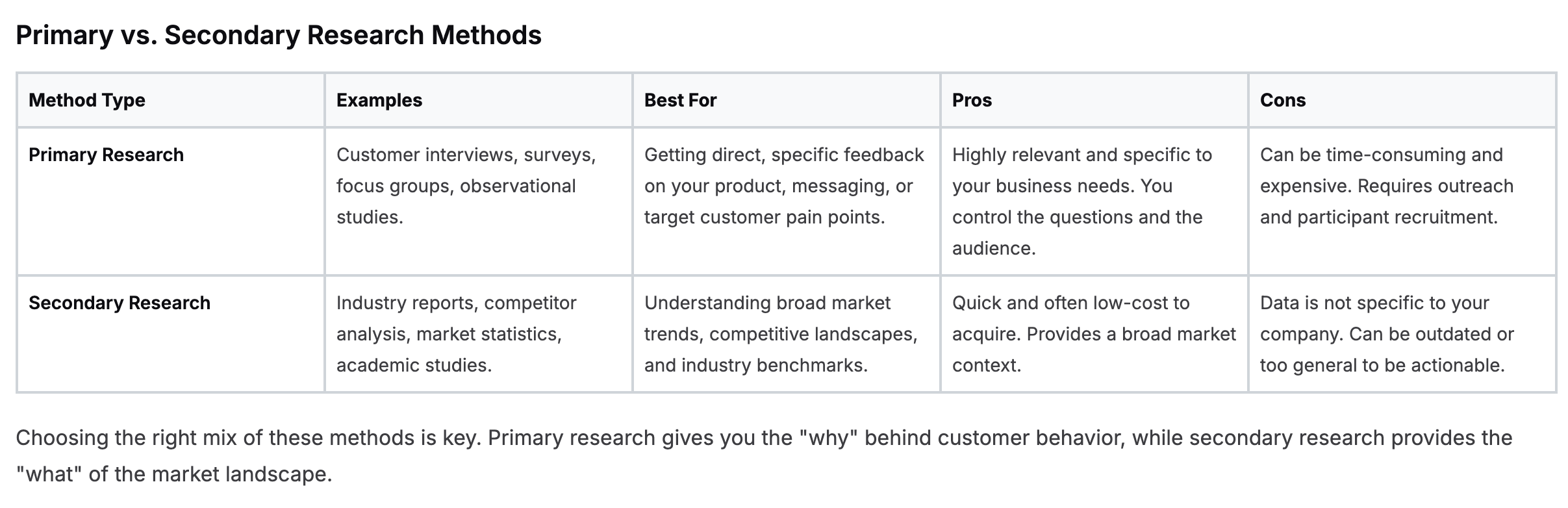

The right research approach depends entirely on your goals. To help you choose the best methods, here’s a quick comparison of the common primary and secondary research options.

Primary vs. Secondary Research Methods

Choosing the right mix of these methods is key. Primary research gives you the "why" behind customer behavior, while secondary research provides the "what" of the market landscape.

The most dangerous pitfall in this stage is confirmation bias—hearing only what you want to hear. Actively challenge your own assumptions and seek out feedback that contradicts your initial beliefs. This is where the real learning begins.

This infographic gives you a good sense of how resources are typically allocated for in-house versus outsourced research projects.

As you can see, outsourcing can often bring in deeper expertise faster and sometimes even at a lower overall cost. That's a critical consideration for any startup trying to make every dollar count.

Ultimately, all these insights are the fuel for your growth engine. They directly inform how you build out your customer journey and your entire sales process. To see how this translates into practice, check out our guide on creating an effective B2B SaaS sales funnel that turns this kind of research directly into revenue.

Turning Your Research Into Real-World Wins

Let’s be honest. Research that collects dust in a report is completely worthless. Its true value only gets unlocked when it sparks meaningful, decisive action. This is the moment where all your hard work in B2B market research finally pays off, turning raw data into a game-changing strategy.

Your goal here is to move way beyond a simple summary of findings. You need to craft a compelling narrative that inspires your entire company to act. This isn’t just about sharing what you learned; it’s about showing everyone what to do next. Your insights need to become the central nervous system of your startup, guiding every decision from product development to sales outreach.

From Insights to Actionable Artifacts

The first step is to synthesize your research into tangible tools that your teams can actually use every single day. Abstract insights are easy to forget, but a well-crafted artifact becomes a source of truth that aligns everyone toward a common goal.

Here are the key assets you should build from your research findings:

- Updated Buyer Personas: Go beyond generic demographics. Use the powerful quotes and observed pain points from your interviews to build rich, empathetic profiles of your ideal customers. Get into the details—their motivations, their daily challenges, and the exact language they use to describe their world.

- A Prioritized Feature Backlog: Your research should be the primary input for your product roadmap. Use the insights you've gathered to rank potential features based on validated customer needs, not just internal assumptions. This is how you ensure you’re always building what actually matters.

- A Refined Messaging Framework: It's time to map your key findings directly to your marketing messages. Pinpoint the value propositions that resonated most strongly in your interviews and use them to sharpen everything from your website copy and ad campaigns to your sales pitches.

If you want to go deeper, our guide on https://bigmoves.marketing/blog/using-buyer-personas-to-accelerate-b2b-marketing-and-sales provides a complete framework for bringing these profiles to life and embedding them across your organization.

The most successful startups treat their research findings not as a final report, but as the first draft of their future strategy. It’s a living document that should evolve as you continue to learn.

Real-World Wins Fueled by Research

The impact of well-executed B2B market research can be profound. It empowers you to make bold, confident decisions that can genuinely alter the trajectory of your business.

Over the years, I’ve seen startups leverage their findings in some incredibly powerful ways:

- Pivoting a Go-to-Market Strategy: I worked with a SaaS company that discovered their ideal customer wasn't the big enterprise client they were chasing, but a highly specific mid-market niche they'd overlooked. They refocused their entire sales and marketing effort and saw their average sales cycle shorten by a staggering 40%.

- Killing a Beloved Feature: A development team was passionately building a complex new feature. But the research was brutal—not a single customer interview mentioned the problem it was designed to solve. Killing that feature saved them four months of wasted engineering time and let them focus on what users were actually asking for.

- Doubling Down on a Niche: Through a series of in-depth customer interviews, another startup found a small but fanatical group of users leveraging their product in an unexpected way. They decided to double down on this use case, building it out and quickly becoming the dominant player in a brand new, highly profitable market segment.

These aren't just feel-good stories; they are real examples of courage and clarity fueled by data. This is the ultimate purpose of your research—to give you the conviction to stop doing what isn't working and go all-in on what will. It's how you turn insights into incredible, real-world wins.

Common B2B Market Research Questions Answered

Even with a solid plan, I get it—actually starting B2B market research can feel like you're staring up at a mountain. Most founders I work with get hung up on the same few questions that stop them dead in their tracks.

Let’s get those roadblocks out of your way. Here are some straight-up, no-fluff answers to the hurdles that are probably on your mind.

How Much Should a Startup Budget for This?

There’s no magic number here. The goal is to be scrappy and resourceful, not to throw cash at the problem. For early-stage startups, your most valuable asset isn't a huge budget; it's your own time and genuine curiosity.

Think low-cost, high-impact. Focus your energy on methods that deliver the goods without a big price tag:

- Customer Interviews: These cost you nothing but your time and will give you the deepest, most unfiltered insights you can possibly get.

- Online Surveys: You can get started for free with tools like Google Forms, or use more advanced platforms like Typeform which have very reasonable entry-level plans.

- Competitor Analysis: Seriously, just digging through customer reviews on sites like G2 and Capterra is a free goldmine. You'll see exactly what people love and hate about the existing solutions.

Instead of thinking in dollars, think in hours. Block out dedicated time for the founding team to just talk to potential customers. Once you start bringing in revenue, a good rule of thumb is to reinvest 1-3% of your annual revenue back into ongoing research. It's how you stay sharp and keep your edge.

What Is the Most Common Mistake to Avoid?

If I had to pick just one, it's confirmation bias. It's the all-too-human tendency to look only for evidence that proves what you already believe. It’s natural, but for a startup, it's a silent killer.

You risk building a product for an audience of one: yourself.

To beat this, you have to approach research like a detective, not a salesperson. Your mission is to uncover the truth, whatever it may be—not to prove you had the right idea from the start.

Instead of asking leading questions like, “Wouldn’t our feature make solving Y so much easier?” try something open-ended. Ask, “Can you walk me through your current process for X?” and just listen.

Actively look for people who disagree with you. Hunt down the dissenting opinions and challenge every single one of your sacred assumptions. That uncomfortable feedback that makes you defensive? That's usually where the gold is buried, shining a light on your biggest blind spots.

This process of gathering unbiased feedback is a core pillar of a strong GTM strategy. The insights you gather here are crucial for shaping how you position your product in the market. To connect these dots, you can learn more about how to define product marketing for your B2B startup in our detailed guide.

How Do I Get Busy Professionals to Talk to Me?

Getting a “yes” from a busy B2B professional isn’t about luck; it’s about respect and leading with value. Mass-emailed, generic requests are destined for the trash folder. You need to be personal, brief, and make it all about them.

Here's how to make it a no-brainer for them to say yes:

- Personalize Your "Why": Show you've done your homework. Reference something specific, like a recent LinkedIn post they wrote or a challenge unique to their industry. This immediately separates you from the noise.

- Offer a Relevant Incentive: A small gift card is fine, but what's often better is giving them something they can't get elsewhere. Think early access to an exclusive industry report you're compiling or some unique benchmark data.

- Remove All Friction: Don't start a back-and-forth email chain to find a time. Use a scheduling tool like Calendly. Let them book a slot in just two clicks.

- Clarify Your Intent: Be upfront. Make it crystal clear you're seeking their expert insight to help you understand a problem in their world, and that this is not a sales pitch in disguise.

At Big Moves Marketing, we turn these kinds of deep market insights into powerful growth strategies for B2B SaaS startups. If you need an expert partner to help you build a clear brand, nail your positioning, and accelerate growth, we’re here to help. Learn how our fractional CMO services can give you a clear roadmap to scale.

%20-%20Alternate.svg)

%20-%20white.svg)